Posted By : Admin on 06-10-2025

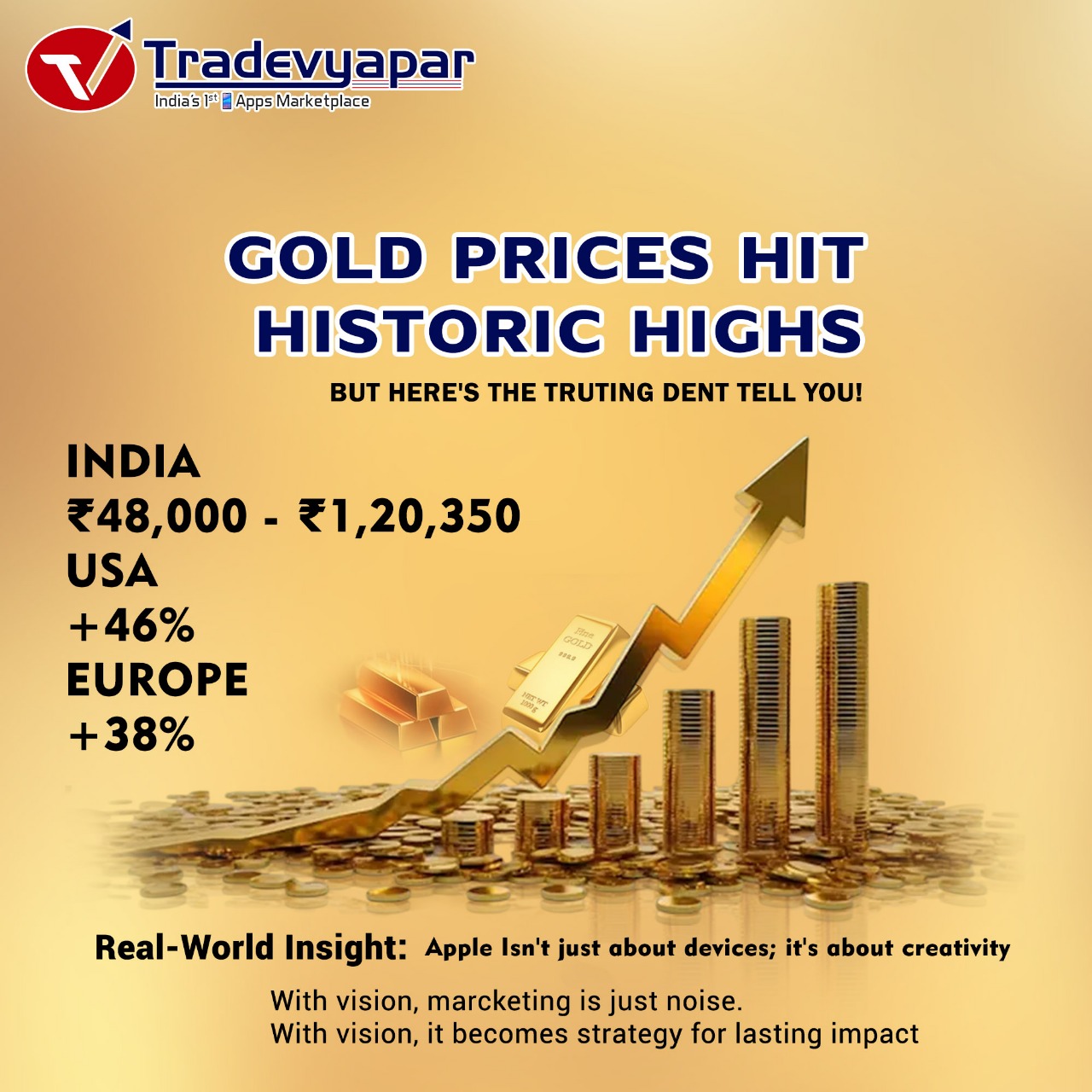

Gold Prices Hit Historic Highs – But Here’s the Truth They Don’t Tell

You!

Gold has smashed all previous records, crossing a

jaw-dropping ₹1,20,000 per 10 grams in India. As of today, it’s trading close

to ₹1,20,350 — the highest ever.

Just a few years ago, gold was selling for around ₹48,000.

That’s a 147% jump in less than five years. But here’s the twist — gold isn’t

actually that expensive everywhere else.

Globally, prices have risen… but nowhere near India’s surge.

USA: $2,650 (2021) → $3,870 (2025) → +46%

Europe: €2,300 (2021) → €3,200 (2025) → +38%

India: ₹48,000 (2021) → ₹1,20,350 (2025) → +147%!

So, why is gold skyrocketing only in India? Let’s break it

down

Part 1: The Falling Rupee

One of the biggest culprits? The Indian Rupee losing value

against the US Dollar.

In 2021, $1 = ₹75

In 2025, $1 = ₹88.66 That’s an 18% drop in the Rupee’s

strength.

And since gold is traded globally in USD, Indians must pay

more Rupees per Dollar to import it. Simply put — where ₹100 could buy gold

earlier, now it takes ₹118.

Part 2: Import Duties, Taxes & Hidden Costs

Even after paying more due to currency exchange, the story

doesn’t end there. India charges:

5% Import Duty

1% Cess

3% GST

2–3% Retail Margin

That’s roughly 12% extra, on top of the 18% currency loss —

meaning Indians pay 30% more than global buyers for the same gold.

Why India Can’t Catch Up

India’s economy still relies heavily on imports. Even for

simple products like fans or electronics, parts come from abroad. Despite

having resources, our industries and mines remain underutilized, making us

import-dependent — even for steel and minerals.

Why People Still Rush to Buy Gold

After demonetization, banking crises, and fear of financial

instability, people have lost faith in cash. Gold is seen as the most liquid

and trusted asset.

Plus, DICGC insurance covers only ₹5 lakh per bank account.

If a bank collapses — that’s all you’re guaranteed. No wonder gold feels safer.

Add to that:

Stock market volatility

Global trade tensions

Uncertain future investments

…and gold becomes the go-to safe haven once again.

The Final Take

Experts remain divided — some predict further growth,

others expect a correction. But here’s one solid piece of advice:

Don’t invest in gold just because everyone else is doing

it. Understand the market, know your risk, and invest smart.

Because in the end, gold shines brightest for those who

think before they buy.